The concept of negative equity in auto loans & resolving it with auto leasing might appear complex at first. In essence, negative equity emerges when the outstanding debt on a vehicle exceeds its current market value. This imbalance can get rolled into a lease agreement, turning it in to a hurdle that can be cleared with much less disruption to your finances.

Understanding Negative Car Loan Equity: The Basics

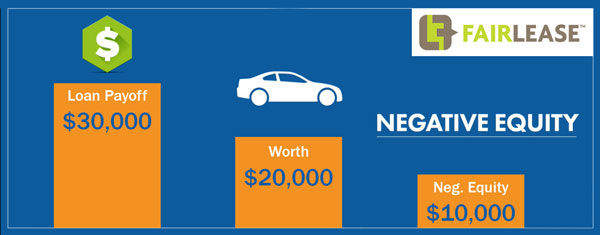

Negative equity is the difference between the value of a car and the payoff.

For example: If you owe $30,000 in the car's only worth $20,000, you will have $10,000 in negative equity. When you try to trade that vehicle in 3 to 4 years, you will have that snowball effect that will continue to go and go until you pay off that car free and clear.

As shown in the diagram above, negative equity arises when the market value of a vehicle drops below the remaining debt on a vehicle's Loan Payoff. This scenario commonly occurs in the early stages of an auto loan when the vehicle's depreciation rate is highest.

What Causes Negative Equity in Car Loans?

Negative equity, often referred to as being "upside-down" on your car loan, arises when the outstanding amount on your auto loan exceeds the current market value of the vehicle. Understanding the multiple factors that can contribute to negative equity can help car owners make informed decisions. Here are the most common causes:

Rapid Vehicle Depreciation

As soon as a new car is driven off the lot, it loses a significant portion of its value – often as much as 20% in the first year. This rapid depreciation can result in the car's value dropping faster than the loan balance decreases. For instance, if you purchase a car for $25,000 and it depreciates 20% in the first year, its value drops to $20,000. However, if you've only paid off $3,000 of your loan, you owe $22,000 – leading to negative equity.

Long-Term Financing

Extended loan terms can lead to slower equity buildup, meaning they extend the time before you reach a break even point. If you've opted for a 6 or 7-year loan, the loan balance might not decrease as quickly as the car's value, especially if the vehicle has a high depreciation rate.

High-Interest Rate

If you've secured your auto loan with a high-interest rate, a larger portion of your monthly payment goes towards the interest rather than the principal. This can slow down the rate at which you're building equity in the vehicle.

Lack of Down Payment

Not making a significant down payment at the onset of an auto loan can result in a larger amount of debt, contributing to negative equity.

Rolling Over Previous Loans

If you've traded in a car with negative equity and rolled that amount into a new car loan, you're starting the new loan already upside-down. This increases the chances of continuing the cycle of negative equity.

High Mileage

This can lower the vehicle's value and increase the chance of negative equity.

Understanding these causes can guide you in your future auto purchasing decisions and help you strategize to avoid or mitigate negative equity.

What are some Financial Implications of Negative Equity and its Impact on Credit Scores?

Negative equity, or being "upside-down" on your car loan, can have far-reaching financial implications. Not only does it mean you owe more on the car than it's worth, but it can also impact your financial decisions and future borrowing potential. Here's how:

Limited Financial Flexibility

Being in negative equity can tie you down. If you wanted to trade in or sell your vehicle, you'd likely have to cover the difference between the loan balance and the car's value. This can strain your finances, especially if you're not prepared for these additional costs.

Higher Interest Costs

If you're upside-down and refinance your car, you might end up borrowing more than the car's worth. This can lead to higher interest costs over the life of the loan.

Impact on Credit Scores

Continuous negative equity, especially if it leads to difficulties in making timely loan payments, can negatively impact your credit score. A lower credit score can:

- Increase interest rates on future loans.

- Make it challenging to secure credit for other purchases, like a home.

- Lead to higher insurance premiums.

- Potentially affect employment opportunities in sectors that review credit scores.

Understanding these implications is crucial. It helps you gauge the importance of avoiding negative equity and taking steps to address it if you find yourself in such a situation.

Negative Equity's Snowball Effect on Future Investments & Lending Requests

One often overlooked consequence of negative equity is its cascading effect on future financial commitments. Being "upside-down" on a car loan can have ripple effects that impact other areas of your financial life:

Decreased Buying Power

The lingering debt from negative equity can limit your purchasing power when it comes to other significant investments, such as buying property or starting a business. Lenders may perceive you as a higher risk, potentially limiting the amount they're willing to lend.

Compromised Negotiation Power

When it's time to purchase or lease a new vehicle, having negative equity can reduce your negotiation leverage. Dealerships and lenders are aware of your financial situation, which might limit the deals or incentives available to you.

Risk of Loan Default

If unaddressed, the financial strain from negative equity can lead to loan default. This not only further damages your credit score but may also result in the repossession of your vehicle.

Emotional and Mental Strain

Beyond the tangible financial implications, the stress from being in a negative equity situation can lead to emotional and mental challenges. The constant worry about debt can affect one's overall well-being and quality of life.

Recognizing the broader implications of negative equity allows for a more comprehensive approach to financial planning. It emphasizes the importance of being proactive in addressing and preventing negative equity situations.

Overcoming Negative Equity: A Strategic Approach

Although negative equity can seem like a daunting prospect, several strategies can help mitigate its impact and put you back on track:

- Increase Payments: Adding extra to your regular payment can help reduce the principal balance faster.

- Hold onto the Vehicle: Holding onto your vehicle for longer can help you catch up as the value of the vehicle decreases more slowly over time.

- Vehicle Trade-In: If the trade-in value of the vehicle is more than the outstanding lease amount, it can cover the negative equity.

Leverage Vehicle Trade-In as a Remedy

Trading in your vehicle might provide an avenue to cover some of the negative equity on an auto loan if its trade-in value turns out to be closer than expected to your remaining loan amount. However, it is vital to understand that this might not always be the case, especially with rapidly depreciating vehicles.

Conclusion: Steer Clear of Negative Equity by Choosing Auto Leasing

In today's fast-paced automotive market, maintaining financial flexibility and avoiding potential pitfalls like negative equity is paramount. While traditional auto loans offer ownership, they come with the inherent risk of negative equity, especially when the vehicle's value depreciates faster than the loan balance reduces.

One might wonder, "Why is leasing better than buying when it comes to negative equity?". The answer lies in the structure of leasing itself. When you lease, you're essentially paying for the vehicle's depreciation over the lease term, not its entire value. This shields you from the brunt of steep depreciation curves, especially seen in newer vehicles.

Here are some reasons why choosing auto leasing can be a smarter financial move:

- No Long-term Commitment: At the end of your lease term, you have the option to return the vehicle, purchase it, or trade it in for a newer model. This flexibility ensures you're always driving a relatively new car without being tied down to it.

- Avoiding Negative Equity: Since you're not taking a loan for the vehicle's full value, you're less likely to owe more than the car is worth. This is especially beneficial in an unpredictable market where vehicle values can fluctuate.

- Lower Monthly Payments: Often, lease payments are lower than loan payments because you're only covering the cost of depreciation, not the full purchase price.

In essence, auto leasing is a protective measure against the unpredictability of vehicle depreciation. It grants you the pleasure of driving a new car every few years without the financial stress of negative equity. However, it's essential to read the lease agreement's fine print, understand the terms, and ensure it aligns with your driving habits and needs. By doing so, you'll enjoy all the benefits of leasing while avoiding potential pitfalls.